Discrimination, from religious persecution to racism, has been a recurring motif in the United States since the nation was founded in 1776. A prevailing belief is that the Civil Rights Movement of the 1960s eradicated these issues, but this is far from the truth. Unfortunately, racial prejudice still coexists in society alongside other types of discrimination, such as those against women, illegal immigrants, and the LGBT community. People are still looked down upon because of the color of their skin. The glass ceiling has not been broken. Hate crimes are committed every day against anyone who dares to be different. Though these may seem like extreme examples, they are just a handful of the issues impacting American citizens today, and each of them constitutes a lack of social justice. In addition to these more prominent issues, social injustice is perpetuated daily in less conspicuous ways that may not immediately come to mind. One of these is the issue of economic inequality. The socially unjust nature of the present economic climate in the United States deserves as much attention as any of the previously mentioned issues. All citizens are entitled to an education, yet some are excluded from the system because they simply cannot afford it. Young adults are prevented from pursuing their dreams and attaining futures that should be possible. Change must occur to remedy the problem that the rising cost of education coupled with the ever-growing wealth gap in the United States has caused. This change could be possible with the help of a mobile application called Thrifty Texts.

In Ann Light and Rosemary Luckin’s (2008) “Designing for social justice: people, technology, learning,” the authors discuss Nobel prize-winning economist Amartya Sen’s view on social justice. Sen believes “justice requires us to enable people to engage in the activities necessary to achieve what they want” (p. 9). In other words, social justice exists when all people have equal opportunity to the means to advance themselves in society in some way. Wealth distribution in the United States is relevant to Sen’s definition of social justice. The gap between the wealthy and the poor is increasing, and there are growing rumblings of a disappearing middle class (Pressman, 2007, p. 182). Higher education is marketed as one way to ensure that individuals can rise above the working class and sustain themselves. In order to secure any well-paying position, having a Bachelor’s degree is now practically a prerequisite. The cost of attending a college or university, though, is astronomical. Students are seemingly faced with no choice, stuck in this Catch-22: a degree is required to secure a job, yet a job is needed to afford a degree. How, then, do average American students afford their education and all the extra costs associated with it?

To understand the answer to this question, it is necessary to explain the context in which it is posed. The gap between the lower class and the upper class in the United States is increasing, and the notion of what has typically been considered the middle class is ceasing to exist. Pressman (2007) explains two approaches that can define the middle class. By economic standards, the middle class can be defined as “having an income that is somewhere in the middle of the income distribution” (Pressman, p. 183). Different organizations such as the United States Census Bureau and the United States Department of Commerce have come up with conflicting determinations for what amount of income constitutes being middle class, ranging from $20,600 to as much as $122,000 per year (Horn, 2013). Pinpointing the number around the median income seems to be the fairest designation of the middle class: $50,054 (Horn). However, being middle class is not just an economic standard but an identity as well. Sociologically, according to Pressman, the middle class comprises “people who have achieved a certain educational level, whose jobs have a certain level of social status, and who have a particular set of values and attitudes” (Pressman, p. 182).

The number of people in the United States who economically fall into the criteria of middle class or even consider themselves a part of it sociologically is decreasing. In 2013, the United States Census Bureau reported that 15% of the American population is living in poverty, an increase of 2.4% since 2011 (2013). Yen writes, “By 2030, based on the current trend of widening income inequality, close to 85% of all working-age adults in the United States will experience bouts of economic insecurity.” This is not the only shocking estimation concerning the current economic landscape in the United States. As of 2008, the top 1% of earners in the United States (defined as those who make $368,000 or more per year) collected 12.4% of the total income in the country (Saez, 2010). The rich are increasing their wealth while the poor become more impoverished. This wealth division has impacted the ability of those from lower class families to access higher education.

The value of a Bachelor’s degree has changed over the past 40 years. In 1973, 47% of high school graduates proceeded to college, but that number jumped to 70% in 2008 (Oloffson, 2009). The prevailing attitude is that “a trip through college is considered as much of a birthright as a driver’s license” (Oloffson), and this has led to an “oversupply of graduates” (Oloffson). Since so many potential employees now possess Bachelor’s degrees, a college education is needed to obtain practically any well-paying position. Now, as more young people attend institutions of higher education whether by choice or out of necessity in order to be considered for even entry-level positions, the cost of attendance has skyrocketed. Steve Odland (2012) writes, “if the cost of college tuition was $10,000 in 1986, it would now cost the same student over $21,500 if education had increased as much as the average inflation rate but instead education is $59,800 or over 2 ½ times the inflation rate.” Despite this extreme increase in cost of attendance, college has not become any more affordable for the average American student. The amount of student loans provided by the government has increased, but as these must be paid back with interest they offer no real break to the student (Odland). The average student loan debt of 2012 graduates was nearly $30,000, a burden carried by seven in 10 students (The Institute for College Access & Success, 2013, p. 1). The total student loan debt owed in the United States “is the highest in history, at over US $1 trillion” (Sobel, 2013, p. 85). Students are digging themselves into a deep hole of debt that may be inescapable for 20 years or more following their graduation.

If earning a Bachelor’s degree is necessary for individuals to ensure that they live above the poverty line, why are colleges and universities charging students exorbitant amounts to obtain one? Higher education’s extreme price tag exceeds the amount of yearly income in a middle class household, thus forcing students of this largest economic segment of the population to saddle themselves with massive amounts of debt. The cost also practically prohibits those from low-income families from attending at all, as “adequate funding for access to postsecondary education is still not an entitlement for poor and working class students in our nation” (Paulsen & St. John, 2002, p. 230). Additionally, there is a proven correlation between youths who come from low-income households and test scores: “more-affluent students as a group always do better than their less-affluent counterparts” (DiMaria, 2007). Thus, it seems as though low-income individuals are born into a disadvantage: their scores are more statistically likely to be low because they are poor and thus they may not even be able to get into college even if they somehow could afford it.

The economic disadvantage facing a majority of the nation’s potential students is extremely unjust. Paulsen and St. John (2002) write, “It has long been evident that class plays an important role in education and attainment and should be considered when critically examining educational policy” (p. 195). Thus, the creation of a mobile application that could decrease the cost of attendance even a fraction for less economically advantaged students would be an innovative tool to promote social justice. Field research conducted in March 2014 at Temple University’s college bookstore provides some insight into the world of textbook needs and fees.

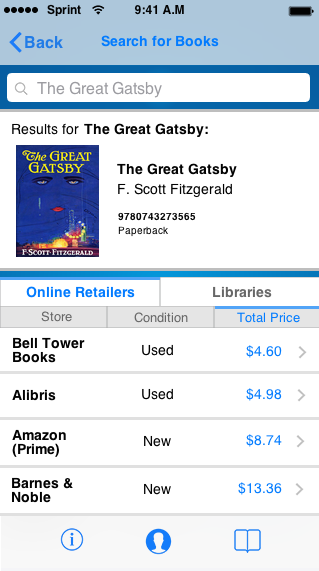

Three individual predicaments presented themselves at the store. The first customer was searching for a book that the store did not have in stock, and he was curious to know if it was in circulation at the university’s library. Understandably, the store can only access their own inventory, so the customer traveled to the library to search through their databases. The second customer used her mobile device to access the title and author of the textbook she needed and showed the bookseller this information. The final customer was aggrieved at the outlandish price of a textbook required for one of his courses. He wanted the bookseller to check its availability on Amazon, but employees are unable to do so because Amazon is in direct competition with college bookstores. Observing this customer’s frustration in particular affirmed the need of a mobile application to remedy customers’ common issues. Countless courses of study require students to purchases books that cost upwards of $300. This fee could be multiplied by five for a full course load, equating to a sum that is frankly unaffordable when appended to already-outrageous tuition prices. As demonstrated by this field research, university bookstores often exhaust their supply of certain titles before all students can purchase them and subsequently cannot help these desperate customers because the employees cannot access any other databases besides their own. Customers often do not even realize that they can check local libraries and borrow the books they need at no cost.

A few mobile applications exist that attempt to address these issues, but none provides an all-encompassing solution. Apps called TextbookMe and BookSearch allow users to search for the cheapest prices of textbooks, but their interfaces are outdated. No apps seem to exist that incorporate the functionality of TextbookMe and BookSearch with library resources. As this would be the cheapest and quickest means to obtain a book if it were in circulation (as opposed to waiting for a purchased book to be shipped), it seems necessary to incorporate libraries into an app of this kind.

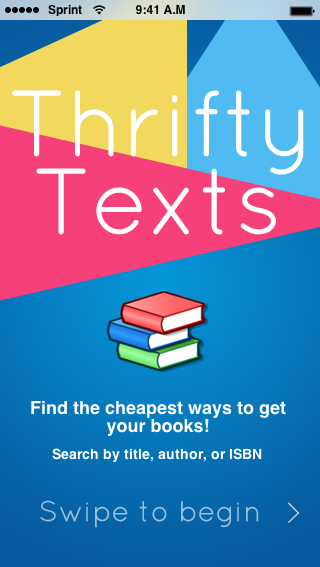

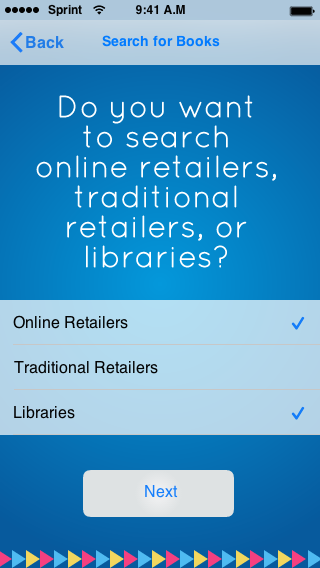

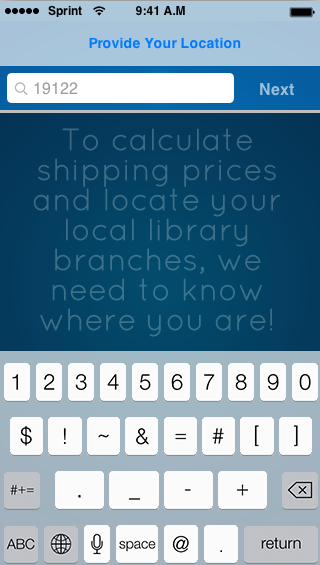

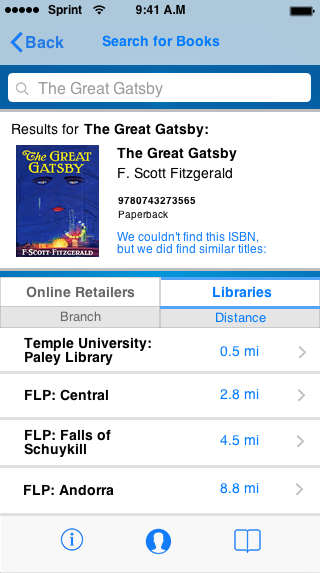

The creation of a mobile application called Thrifty Texts could fill in the gaps where TextbookMe and BookSearch are lacking. The app would allow a student to type in the title, author, or ISBN of the book they need for their class. Then, the app would search the databases of popular online book retailers (Amazon, Chegg, and Half.com, among others) and compare the price of the book from each retailer. It would factor in shipping costs and, in Amazon’s case, provide results that ship direct from the company as well as those that ship from private sellers. Additionally, Thrifty Texts would provide prices for in-person bookstores whose inventories are available online, such as Barnes and Noble, if the student wished to purchase at a store. The most useful function of the app and the one that would set it apart from similar existing apps, though, would be its ability to search local library databases. Though city libraries often do not have textbooks, they do have trade books available that are used in many college courses. The app would also be able to search university libraries’ inventories. Thrifty Texts would thus enable students, who are already paying the price of college tuition, to decrease their cost of attendance. It would ideally encourage potential students who are debating whether or not to follow the path of postsecondary education because of its cost to enroll if they see that textbooks can be less of an expense than they think.

Thrifty Texts takes advantage of mobility by allowing users to immediately consult the application wherever they may be located in physical space. As Kakihara and Sorensen (2001) explain, with the growing presence of mobile devices, “geographical distance no longer remains a fundamental aspect of the interaction – the boundary between ‘here’ and ‘there’ dissolves” (p. 34). If a student is assigned a book in class, for example, he or she can immediately search for the cheapest copy on the spot instead of having to wait for access to a computer. If the student were in the college bookstore, he or she would be able to use the app to determine whether it would be more cost effective to wait and purchase the book from an online retailer. Mobility is especially important to the library aspect of the application, as these institutions typically only possess one or two copies of a given book. Thrifty Texts would immediately allow a student to know if a book was in circulation so they could secure the text as soon as possible before someone else checked it out.

Some preexisting structures would make Thrifty Texts possible. Textbook retailers having stock online is important; access to preexisting databases such as those belonging to Amazon or Chegg is necessary for the app to use as an information source. Additionally, both city library systems and those belonging to universities are important to the functioning of an app of this kind. The intra-library loan agreements that many higher education institutions have with one another extends the capabilities of Thrifty Texts, too. If the desired book is not available at the student’s home university library, they can search the inventory of any partner school’s library. If the book is in circulation, it can be shipped directly to the student’s home university library for no fee.

Though geared specifically toward college students, Thrifty Texts would theoretically be accessible to anyone wishing to find the cheapest price for a book. A potential feature of the application’s design, though, could be to somehow implement a login system the allows a student to sign in using his or her institutional credentials to tailor results directly to each individual’s needs. If this became a feature of the app, those who are not students, faculty, or staff of a college or university would be unable to access the application. Perhaps a way to address this issue would be to make the login optional. Instead of forcing users to sign in to use Thrifty Texts, they could have the option to use it without doing so. Logging in would provide a bit personalization to enhance the overall user experience, but it would not prohibit anyone from using the application entirely. Additionally, those who do not wish to supply their location for any reason (privacy concerns, they do not know the zip code of their current location, etc.) would be unable to access the library and local retailers portions of the app. For the online retailers feature, they could only be provided with estimated shipping costs instead of one that is tailored especially to their location. The latter is only a matter of convenience and would not impact the actual functioning of the application. Even if they did not want to provide their location, users would still be able to search online retailers for the cheapest prices.

The aforementioned group of users that may wish not to enter their zip codes for privacy reasons call other such issues into question. Thrifty Texts would gather two types of data. First (and most obviously), the application would collect location information. However, users are protected because these details are only collected on a voluntary basis. The user has to choose whether or not to input their zip code, and that is the only information the application receives. It would not use the mobile device’s location services to track the user’s current location, nor would it save the information that the user inputs. As previously explained, too, this step can be bypassed if the user does not wish to share their location. If an institutional login were incorporated into the app, it would collect information about the user’s credentials as well as data about the user’s university and his or her identity. Because universities would have to approve Thrifty Texts to access their databases, the app would first need to be proven secure in order for institutions to even be willing to let the app access students’ login information. Additionally, the app protects users’ privacy by not prohibiting purchases from actually being made through Thrifty Texts. If users do decide to purchase a book they have found while searching on the app, they can click through to the store’s website on which the book is being sold to complete the transaction. Thus, the application never sees users’ payment information.

Thrifty Texts (design mockup pictured below) would be one small step to remedy a prevalent social injustice in America: the rising cost of postsecondary education. The American middle class is shrinking, and the gap between the rich and the poor is steadily widening. Concurrently, more people than ever before are attending college to attain a Bachelor’s degree because it now equates to the high school diploma of generations past. The overabundance of graduates has caused a societal shift: possessing this degree is a requirement for most well-paying jobs. The cost of college has outpaced inflation and, because the wealth division in America is growing and employers view degrees as a hiring requirement, students are saddled with record amounts of debt. Potential undergraduates who cannot even get approved for loans are shut out of the system completely and have no opportunity to further their education. Thus, this mobile application that can perhaps assuage the financial burden of attending an institution of higher education by allowing students to get the best bargains on required textbooks promotes economic justice in society.

References

DiMaria, F. (2007). Math scores on the rise…low-income/minority gaps persist. The Hispanic Outlook in Higher Education, 18, 23-24. Retrieved from http://search.proquest.com

Horn, D. (2013). Middle class is a matter of income, attitude. Retrieved April 3, 2014, from: http://www.usatoday.com/story/money/business/2013/04/14/middle-class-hard-define/2080565

Kakihara, M. & Sorensen, C. (2001). Expanding the ‘mobility’ concept. SIGGROUP Bulletin, 22(3), 33-37. Retrieved from https://mobmed14.files.wordpress.com/2013/01/kakihara-and-sorensen_mobility.pdf

Light, A. & Luckin, R. (2008). Designing for social justice: people, technology, and learning. Opening Education. Retrieved from https://mobmed14.files.wordpress.com/2012/11/designing_for_social_justice.pdf

Odland, S. (2012). College costs out of control. Retrieved April 4, 2014, from: http://www.forbes.com/sites/steveodland/2012/03/24/college-costs-are-soaring

Oloffson, K. (2009). The job market: is a college degree worth less? Retrieved April 4, 2014, from: http://content.time.com/time/business/article/0,8599,1946088,00.html

Paulsen, M. B. & St. John, E. P. (2002). Social class and college costs: examining the financial nexus between college choice and persistence. The Journal of Higher Education, 73(2), 189-236. Retrieved from http://www.jstor.org

Pressman, S. (2007). The decline of the middle class: an international perspective. Journal of Economic Issues, 41(1), 181-200. Retrieved from http://www.jstor.org

Saez, E. (2010). Striking it richer: the evolution of top incomes in the United States (updated with 2008 estimates). Retrieved April 17, 2014, from http://eml.berkeley.edu/~saez/saez-UStopincomes-2008.pdf

Sobel, A. E. K. (2013). The escalating cost of college. Computer, 46(12), 85-87. Retrieved from http://ieeexplore.ieee.org

The Institute for College Access & Success. (2013). Student debt and the class of 2012. Retrieved April 17, 2014, from: http://www.ticas.org/files/pub/classof2012.pdf

United States Census Bureau. (2013). Income, poverty, and health insurance coverage in the United States: 2012. Retrieved April 17, 2014, from: http://www.census.gov/prod/2013pubs/p60-245.pdf

Yen, H. (2013). 4 in 5 in USA face near-poverty, no work. Retrieved April 3, 2014, from: http://www.usatoday.com/story/money/business/2013/07/28/americans-poverty-no-work/2594203/

Visual Design References

FluidUI. (2014). Fast Friendly Mobile Prototyping. Retrieved April 15, 2014, from https://www.fluidui.com.

The Great Gatsby cover [image]. Retrieved April 15, 2014, from http://en.wikipedia.org/wiki/File:Gatsby_1925_jacket.gif.

[Untitled image of books]. Retrieved April 15, 2014, from http://www.wlac.edu/library.

This does in any way discount the argument you are making, but it is important to remember that the number of people starting college does not equal the number who have completed college. So although it might be the case that 70% of people go from high school to college now, the number of people with college degrees is still under 30% (http://www.census.gov/prod/2012pubs/p20-566.pdf). These numbers will likely continue to increase, as they don’t reflect the most recent increases in enrollment, but the “overabundance” of people with college degrees is often overstated. Moreover, part of the large discrepancy between people starting and finish college maybe related to economics, further demonstrating the impact of your app design. Great job on this assignment overall!